Regulatory Framework of Corporate Governance Rules and FAQs

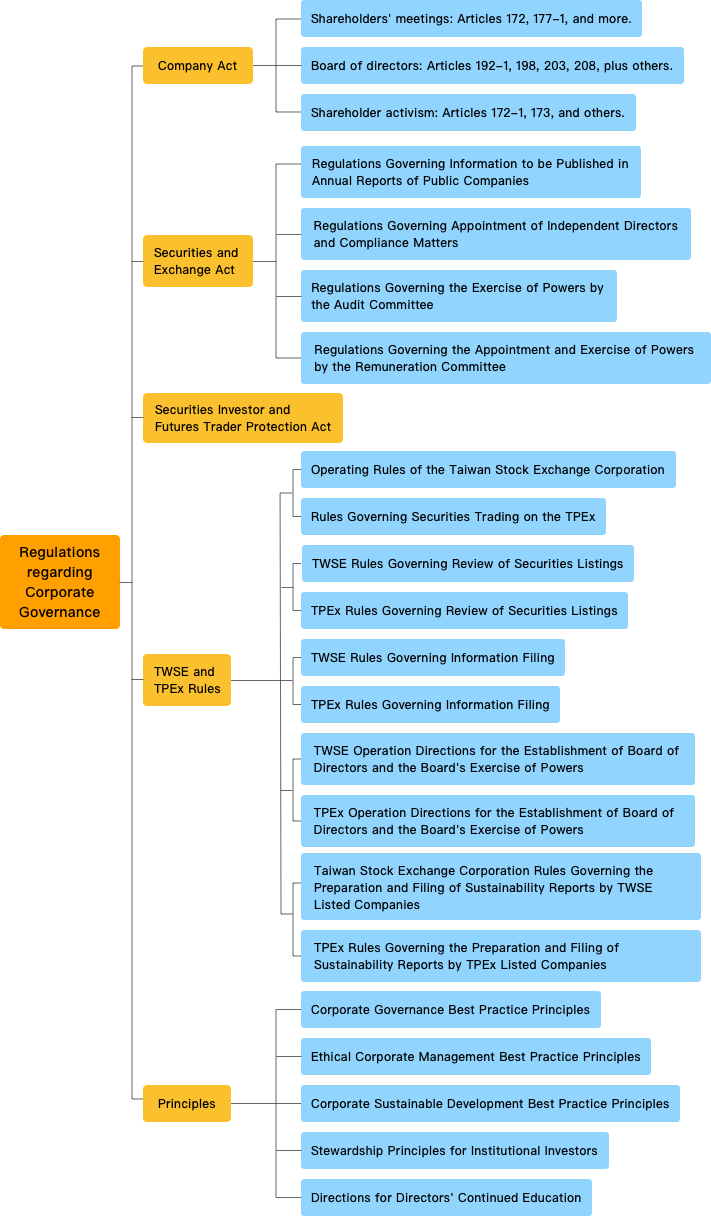

Corporate governance-related laws are mainly structured within the "Company Act," "Securities and Exchange Act," and regulations regarding TWSE/TPEx listed companies formulated by the TWSE and TPEx. The "Company Act" oversees the operations of shareholders' meetings, board of directors, and supervisors and has established systems such as electronic voting, proxy attendance with power of attorney, and shareholder proposals with the goal of augmenting corporate governance with regulations regarding shareholders' meetings, board of directors, and shareholder activism in place.

To strengthen corporate governance, the "Securities and Exchange Act" was amended in 2006, introducing the system of independent directors or audit committee. In 2010, the "Securities and Exchange Act" further stipulated that TWSE/TPEx listed and TPEx emerging stock board registered companies should establish a remuneration committee to strengthen the functions, structure, and operations of the board of directors. By the power vested in them through the same act, the FSC enacted the "Regulations Governing Appointment of Independent Directors and Compliance Matters," "Regulations Governing the Exercise of Powers by Audit Committees," and "Regulations Governing the Appointment and Exercise of Powers by the Remuneration Committee of a Company Whose Stock is Listed on the Taiwan Stock Exchange or the Taipei Exchange" for TWSE/TPEx listed companies to abide by.

To assist TWSE/TPEx listed companies in establishing a good corporate governance system and to promote the sound development of the securities market, the TWSE and TPEx have enacted the following rules and regulations for TWSE/TPEx listed companies to abide by: "Taiwan Stock Exchange Corporation Rules Governing Review of Securities Listings," "Taipei Exchange Rules Governing the Review of Securities for Trading on the TPEx," "Operating Rules of the Taiwan Stock Exchange Corporation," "Taipei Exchange Rules Governing Securities Trading on the TPEx," "Taiwan Stock Exchange Corporation Procedures for Verification and Disclosure of Material Information of Companies with Listed Securities," "Taipei Exchange Procedures for Verification and Disclosure of Material Information of Companies with TPEx Listed Securities," "Taiwan Stock Exchange Corporation Rules Governing Information Filing by Companies with TWSE Listed Securities and Offshore Fund Institutions with TWSE Listed Offshore Exchange-Traded Funds," "Taipei Exchange Rules Governing Information Reporting by Companies with TPEx Listed Securities," "Taiwan Stock Exchange Corporation Operation Directions for Compliance with the Establishment of Board of Directors by TWSE Listed Companies and the Board's Exercise of Powers," "Taipei Exchange Directions for Compliance Requirements for the Appointment and Exercise of Powers of the Boards of Directors of TPEx Listed Companies," "Corporate Governance Best Practice Principles for TWSE/TPEx Listed Companies,"" Sustainable Development Best Practice Principles for TWSE/TPEx Listed Companies," and "Ethical Corporate Management Best Practice Principles for TWSE/GTSM Listed Companies."

On July 17, 2002, the President of Taiwan promulgated the "Securities Investors and Futures Traders Protection Act, " which became effective on January 1, 2003. The Securities and Futures Investors Protection Center is an organization set up under the Act to provide consultation on the trading of securities and futures as regulated by related laws and regulations; mediation of disputes arising from the trading of securities and futures; and litigation services on behalf of investors. In addition, the Center manages a protection fund to compensate investors if a securities or commodities firm is unable to do so due to financial difficulties.